Sobre a Fazenda Suynan

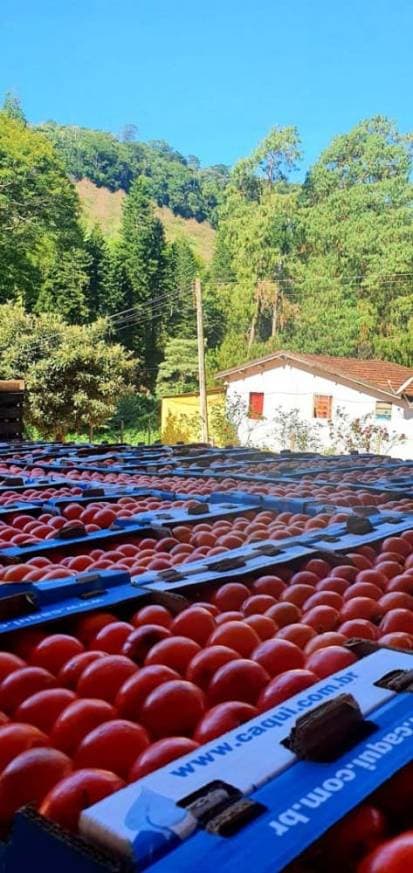

A Fazenda Suynan produz Caqui Rama-Forte com alto padrão de qualidade. Trabalhamos com diversos modelos e formas de embalagens, de acordo com a necessidade do cliente. Estamos situados na Região Serrana do estado do Rio de Janeiro, no município de São José do Vale do Rio Preto.

Se você precisa de caquis super selecionados e escovados, fale conosco.

Caqui Rama-Forte

É o preferido do mercado brasileiro. Os frutos do rama-forte são de tamanho médio a grande, de formato achatado. A polpa é firme, macia e refrescante.

A colheita na Fazenda Suynan se estende de janeiro a fins de maio. O fruto é muito saboroso,com 13 a 14º Brix. Este cultivar apresenta vantagens porque produz frutos resistentes, que conservam-se por até 10 dias após tratamento em estufa, em nossa fazenda. Como conseqüência, obtêm-se facilidades no transporte e na comercialização.

Vitamina C

Evita o aparecimento de câncer, arteriosclerose, previne contra o envelhecimento e acelera o processo de cicatrização.

Vitamina A

Acelera o crescimento das crianças, auxilia o funcionamento da visão e confere resistência contra as bactérias.

Caroteno e Tanino

Possui efeito regenerador da ressaca, após ingestão excessiva de álcool.

Caqui, um Aliado do Seu Coração

Num estudo que comparou a maçã e o caqui na prevenção de problemas cardíacos, o segundo levou vantagem. De acordo com a pesquisa, publicada no Journal of Agricultural and Food Chemistry, o caqui contém maior concentração de fibras alimentares, minerais e compostos fenólicos, substâncias aliadas na luta contra a arterosclerose, a formação de placas de gordura nas artérias.A receita de Shela Gorinstein, líder do trabalho: comer um caqui médio (por volta de 100 gramas) por dia.

Experimente: Corte horizontalmente a parte superior de um caqui macio e acrescente um pouco de conhaque ou vinho, e sirva em seguida tomando com uma colher.

Características: O caquizeiro é cientificamente denominado Diospyros kaki L., pertencendo à família das Ebenáceas. A planta é originária da Ásia, onde é cultivada há séculos, notadamente da China e do Japão. Daí se espalhou para quase todas as regiões de clima temperado e subtropical.

Veja a comparação entre o caqui e outras frutas aqui.

O Caquizeiro

O caquizeiro é uma planta caducifólia, ou seja, perde as folhas e permanece em dormência no inverno, a exemplo de fruteiras de clima temperado. Por se tratar de uma planta de clima subtropical, existem variedades que são pouco exigentes a baixas temperaturas para quebrarem a dormência, e outras que são mais exigentes.

A dormência, em geral, é governada por fatores genéticos e do meio ambiente que afetam o nível de substâncias reguladoras de crescimento, as quais controlam as trocas metabólicas que conduzem à quebra de dormência. Dentre os fatores ambientais que geralmente influem na atividade de crescimento estão a temperatura, o fotoperíodo, as condições nutritivas e o suprimento de água.

A Maturação

Na maturação dos frutos, ocorrem degradação da clorofila, aumento do teor de carotenóides, especialmente da criptoxantina, transformação de cloroplastos em cromoplastos e, conseqüentemente, mudança da coloração, tanto da polpa quanto da casca do fruto. A redução da firmeza é outra mudança observada que decorre do aumento da atividade das enzimas poligalacturonase, celulase e pectinametilesterase. Porém, uma das mudanças mais evidentes é a perda de adstringência de frutos taninosos. A adstringência é causada pela coagulação das proteínas da saliva e o epitélio mucoso, pelos fenóis solúveis, presentes em frutos imaturos, sendo indesejáveis ao paladar. A perda da adstringência ocorre devido à polimerização dos compostos fenólicos (taninos), tornando-os insolúveis, reduzindo, assim, sua atividade.